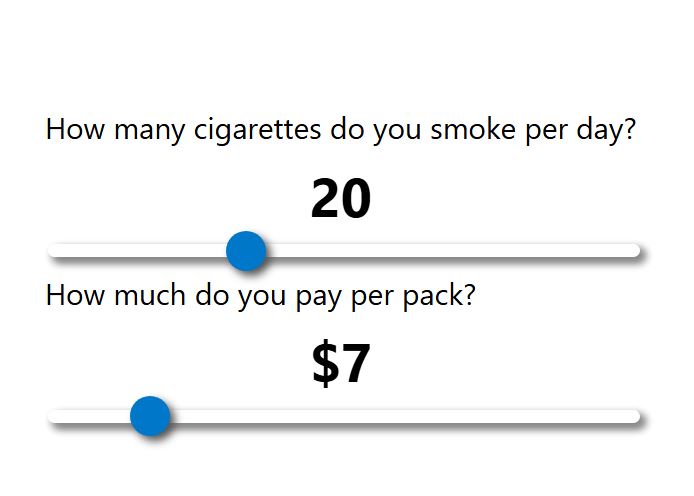

This is an exercise in financial opportunity cost and compound interest. The idea is to help smokers visualize the financial opportunity cost of smoking. It answers the question “How much money would I have if instead of smoking I invested?” Move the sliders below to try it out.

| In… | You Spend | If You Invested That Money You Would Have |

|---|---|---|

| 1 Day | — | — |

| 1 Week | — | — |

| 1 Month | — | — |

| 1 Year | — | — |

| 10 Years | — | — |

| 20 Years | — | — |

| 30 Years | — | — |

You don’t have to use it for smoking though, you could also use it to see how much you would save by giving up your daily latte, or how much money you would have if you invested $5 every day for 10 years. To do this, you should set the cigarettes per day to 20 (1 pack).

Annual return on investment is set at 10%, based on the average annual S&P 500 performance over the past 100 years. Return on investment is calculated using the compound interest with daily contributions formula: